We’ve helped thousands of entrepreneurs control their business finance – simply, quickly, and affordably.

Create a complete 5-year budget from scratch in less than an hour!

We automatically set up your business based on where you are in the world.

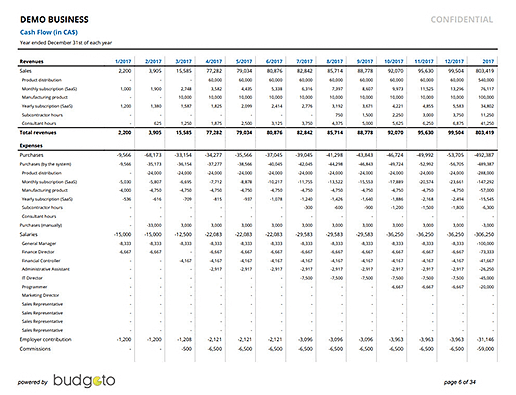

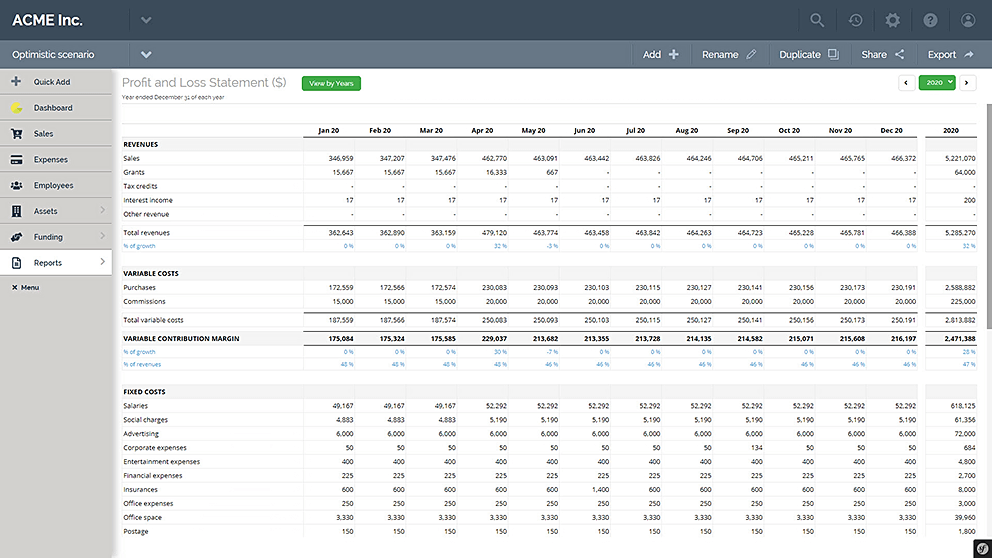

You create your budget by filling out the various forms available in the application.

Each time you fill out a form, Budgeto automatically performs all the calculations.

Are you a product distributor, a restaurant owner or a consultant? Budgeto is for you!

Copy-paste a budget, change your assumptions and see the impact live!

Work on your budget with your shareholders, employees, accountants or bankers!

Share your budget with the partners of your choice and start collaborating right now.

Instantly print beautiful professional PDF files or export your budget to Excel.

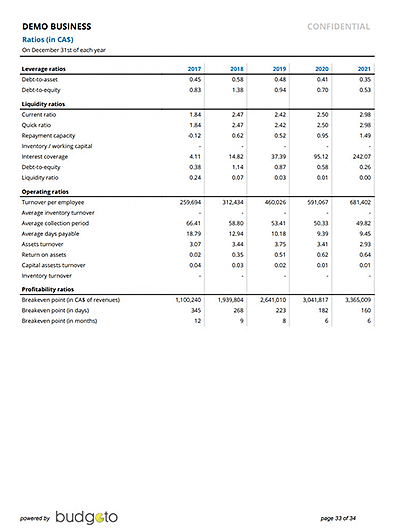

Meet the expectations of the most demanding investors!

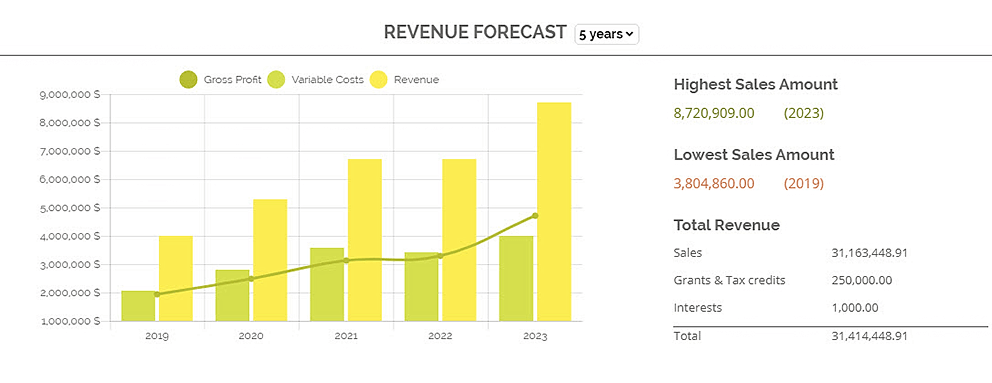

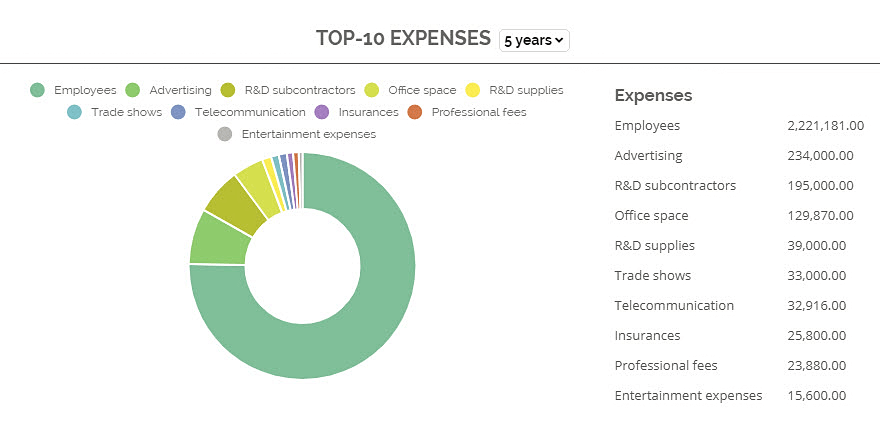

The benefits of budgeting should never be underestimated when running a business. A detailed and realistic budget is one of the most important tools for guiding your business. Budgeting is the basis for all business success. It helps with both planning and control of the finances of the business.

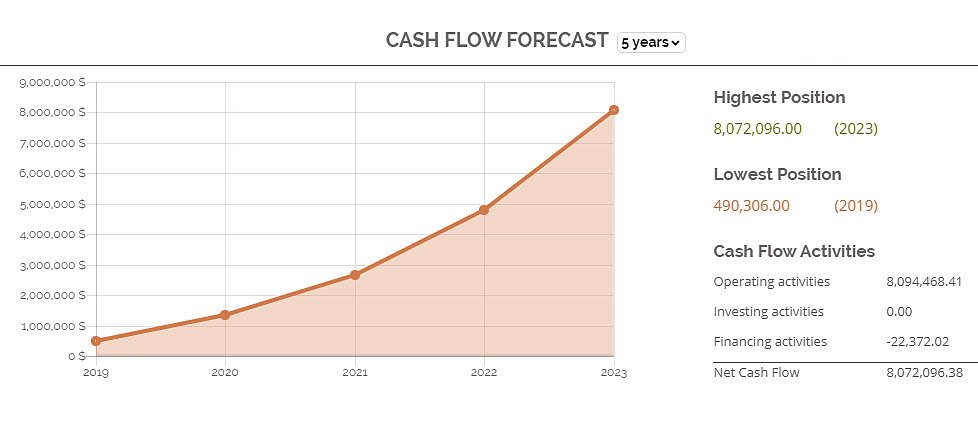

Cash flow management is the most important aspect of every business. According to a study performed by Jessie Hagen of U.S. Bank, 82 percent of businesses fail because of poor management of cash flow. As a business owner, you need to have a clear view of your cash flow forecast.

Successful businesses allocate time to create and manage budgets and regularly monitor their financial situation and business performance. Adjusting financial forecasts based on actual results is critical to get a clear view of the financial health of your business.

According to the Small Business Association, “All businesses, whether startup or growing, will be required to supply prospective financial data. Most of the time, creditors will want to see what you expect your company to be able to do within the next five years. Each year’s documents should include forecasted income statements, balance sheets, cash flow statements, and capital expenditure budgets.”

Preparing detailed budgets and sticking to them can help show lenders or potential investors that you can develop a business plan and make it work. Lenders and investors certainly will want to dig deeply into your finances, but if they don’t see evidence of strong budgeting practices, it might be enough of a red flag to turn them away.

Are you really going to spend $7 on a salted caramel mocha latte, but you’re going to hesitate to invest $2 to control the financial future of your business?

*Don’t worry you will be able to plan your coffee budget in the expenses menu 😉

Budgeto © 2025